How to Add Identifiers in Practice Provider Profile?

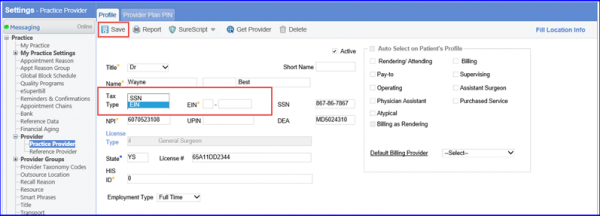

Entering the ‘Social Security Number’ (SSN) and ‘Employer Identification Number’ (EIN) helps in minimizing claim rejections rate by sending only valid information in Claim Files.

Follow the workflow above to land on the provider’s profile screen.

Go to the ‘Tax Type’ dropdown menu and select ‘SSN’ or ‘EIN’ of the provider.

Upon selecting the required ‘Tax Type’ category, the selected field becomes mandatory.

‘EIN’ becomes mandatory only if ‘EIN’ is selected as the ‘Tax Type’; otherwise, the default ‘Tax Type’ is set as ‘SSN’.

Furthermore, both SSN and EIN accepts only Numeric values.

Once done click on “Save” button to store the settings.

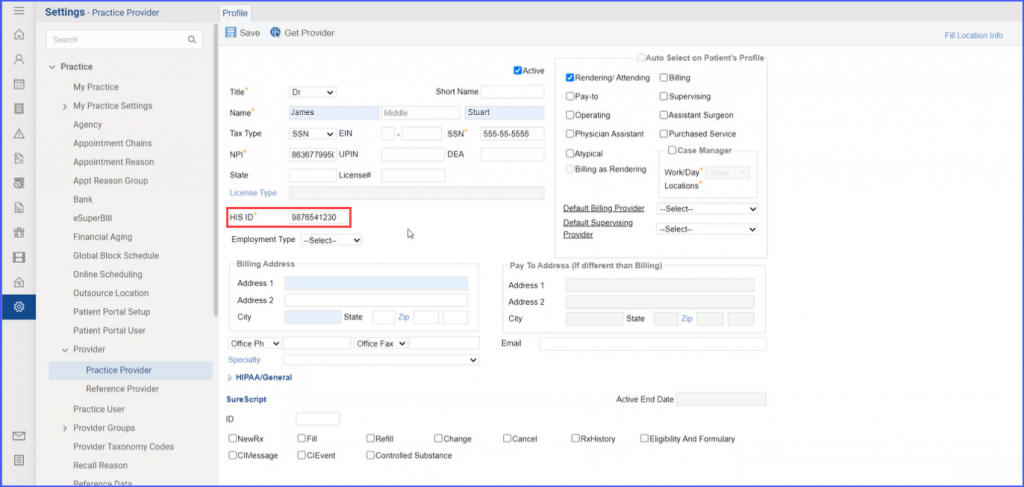

Recognizing the need for consistent ID management, the character limit for HIS ID has been increased to 10 characters.![]()