Payment Processing Partner – Global Pay

Service Details:

Global Payments Integrated (GPI) delivers secure, personalized and fast payment solutions for healthcare industry. Its innovative and reliable business model helps in monetizing payments revenue, and elevate payment experience by removing unnecessary frictions.

As the integrated payments division of Global Payments, GPI is driving innovation – adapting, scaling and simplifying how payments are processed, across platforms and points-of-interaction, in an increasingly complex landscape. Global Payments Integrated serves over 2,000 technology partners across 60 industries throughout the United States (US) and Canada.

Global Payments Integrated can help practices increase efficiency by checking patients in quickly, getting paid faster through omni-channel platform, and perform automatic posting to patient ledger. Practices can offer more options by accepting all major payment types, including HSA/FSA, secure EMV chip cards, contactless digital wallets and many others to streamline the patient experience. Moreover, practices can securely store cards on file to allow recurring payments, and rely on constant and dedicated support from experts.

Global Payments Integrated & CureMD

“CureMD has selected Global Payments Integrated as their preferred partner for payment processing, developing a PCI-compliant payment solution that is custom built for our clients”.

Key Benefits of Global Payments Integrated

Global Payments offer a diverse range of benefits when it comes to seamless payment processing. Few of the key benefits are mentioned below for a more detailed insight.

Single Source Provider:

GPI owns and administers every aspect of the transaction lifecycle. The gateway, processing host, and settlement platform are proprietary to Global Payments as an acquirer. There are no middlemen or third-parties are involved. This creates a simplified implementation process and single source for customer support.

Auto Posting Capability:

No manual, tedious reconciliation is required from standalone terminal as all forms of transactions are posted automatically to ledger in CureMD. This helps in saving time and money used by the billing office managers in recording private pay transactions within CureMD.

Healthcare Specific Functionality

Following healthcare specific features have been included in Global Payments to increase collections while decreasing patient aggravation at the same time. These features or functionalities include:

- Text to Pay

Text-to-Pay, also sometimes referred to as SMS (Short Messaging Service) payment, is a payment solution that allows consumers to make a payment via test message from their smartphones. With Text-to-Pay feature, consumers can send invoices to their clients via SMS. The clients can then complete the purchase by texting a response or clicking on a link, to send the transaction information.

- EMV/EMV Card Readers

EMV – a global standard for credit cards – uses computer chips to validate chip-card transactions. EMV cards are smart cards (also known as chip cards) because their data is stored on integrated circuits. Unlike the old magnetic-stripe cards, whenever an EMV card is used for a payment, the chip card creates a unique transaction code that can only be used once. Moreover, due to dynamic authentication, financial data is more secure on a chip card as the data is constantly changing.

Similarly, the EMV-certified card readers offer better protection and help businesses avoid fraud liability.

- Card-On-File/Recurring Payment

Card-on-File (CoF) transactions refer to those credit or debit card payments made using credentials stored by the merchant. The most common use of card-on-file transactions is for the recurring charges linked with a subscription. Moreover, they can prove to be a fast and convenient method of payment for a customer who make frequent purchases from a single merchant.

- Decline Minimizer

Decline Minimizer is a service that is used automatically update card details that are saved in the system for recurring transactions. For instance, if a customer gets a new card that has a new expiration date, the service will automatically update the card details in the system. This feature not only eliminates the need for you to ask for updated card information from your customer, but also reduces the chance of transactions getting declined for that card.

- HSA/FSA Card Support

Global Payments Integrated facilitates HSA/FSA card for deductible health coverage.

Plug & Play Device Options

Easy-to-implement payment devices (such as card readers) are provided that do not require any special installation. These devices are lightweight, compact and self-contained, capable of fast, secure and convenient transactions.

Integrated Solutions

Genius/Edge Card Present (P400 and e285)

Verifone P400 and 3285 are two of the highly secure payment devices used by Global Payments Integrated, which ensure increased security and reduction in card-present frauds. Both devices are integrated with CureMD to allow our customers perform seamless and secure transactions when the card is present.

P400

The Genius P400 is an electronic device which requires a PIN to be verified in order to initiate the transaction. The P400 uses the latest Linux based operating system to enhance user experience. Being highly secure, P400 device does not share any sensitive cardholder data with your POS.

Following are few of the key features of P400:

- Comes with an Ethernet connection

- Facilitates End-to-End encryption

- Offer contactless point of sales services

- Allows Manual Entry

- Provides with smooth Web service integration

- Supports both web and locally installed applications

- Capable of catering multiple merchants

- Provide solutions that give merchants the ability to offer individualized loyalty rewards, discounts, personalized content, pay with point and more

- Facilitates Bluetooth functionality

- Has NFC/CTLS Enabled

- Accepts payments of type EMV, MSR and NFC/CTLS

- PCI PTS 5.x approved

e285

The e285 is a touchscreen, mobile point-of-sale (POS) device used for secure payment acceptance. It is part of VeriFone’s Engage family of payment solutions. The device offers pay at table facilities along with the portable and mobile POS products that harness the power of the fully integrated, Linux-based platform in the palm of the hand.

Following are few of the key features of e285:

- Offers contactless point of sales services

- Allows Manual Entry

- Provides with smooth Web service integration

- Supports both web and locally installed applications

- Capable of catering multiple merchants

- Comes with pre-certification for EMV

- Is compatible with Windows/iOS and Android

- Runs on the latest version of Linux Operating System

- Accepts payments of type EMV, MSR and NFC/CTLS

- Rechargeable battery (1800 mAh)

- PCI PTS 5.x approved

Card Not Present

Situations in which the card is not present, manual entry could be made over the phone and by using the patient-facing portal. When the card is not available, the cardholder enters the key directly into the PM/EHR to perform the required transactions.

Aside from direct key entry, CureMD and Global Payments together offer other key features as well with card not present integration. These features include:

- Tokenization/card on file capabilities (omnichannel)

- Auto-posting for simple reconciliation

- PCI PA-DSS Compliance covered by Payfields API

- Global Payments Integrated UI

- Automatic updates of lost, stolen and expired credit cards to reduce declines

Text-to-Pay

Text-to-Pay integration offers a variety of features, including:

- Text-to-Pay and Email-to-Pay options

- Patient statements, payment reminders and payment links are shared via text messages

- No special logins required on payment portals

- ApplePay, Auto-Complete, Tokenization, and OCR is supported

- Auto-posting for simple reconciliation is supported

Application Workflows

Three different application workflows have been explained below to help users understand how online payments can be made from CureMD system.

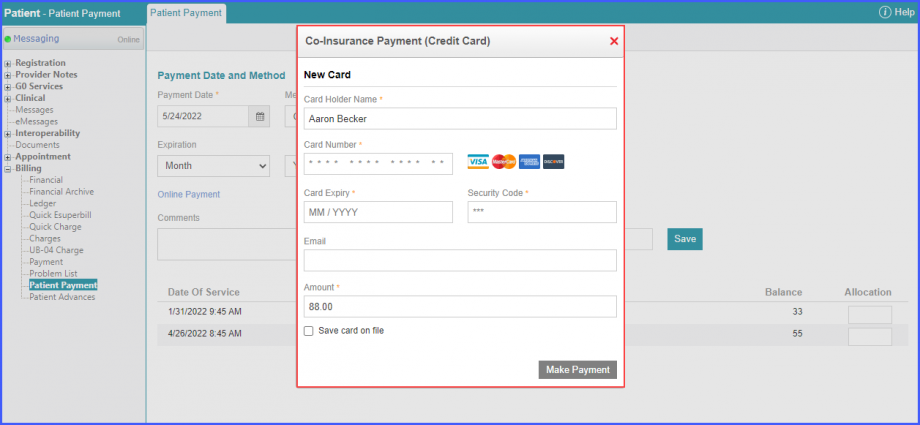

From Patient Module:

For online payments through patient module, follow the workflow Patient > Billing > Patient Payments. After landing on the ‘Patient Payment’ page, select ‘Credit Card’ option from the ‘Method’ dropdown. The system displays ‘Online Payment’ hyperlink under ‘Expiration’ field. Clicking ‘Online Payment’ displays a ‘Co-Insurance Payment (Credit Card)’ popup. Here, add the required details and click on ‘Make Payment’.

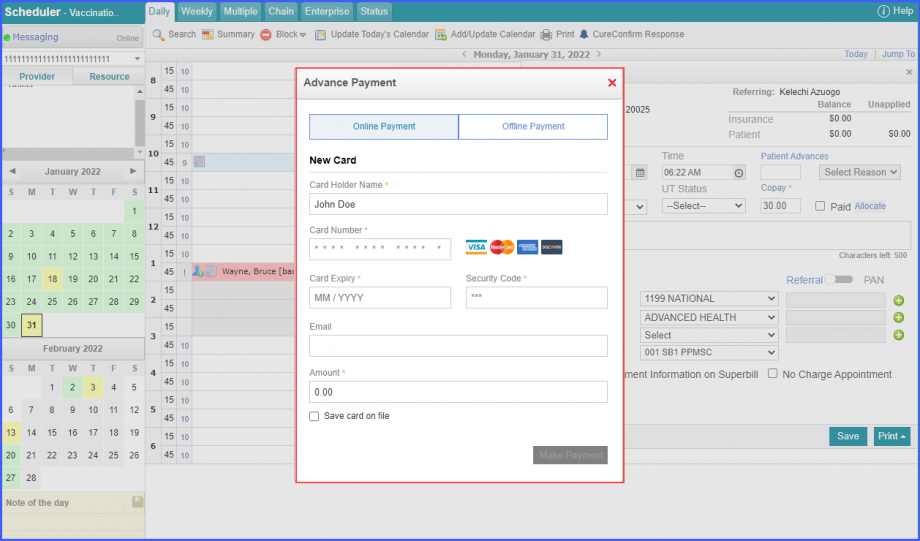

From Scheduler Module:

For online payments through Scheduler module, follow the workflow Scheduler > Daily/Multiple/Chain/Weekly/Enterprise > Appointment (Left Click) > Check in > Patient Advances > Online Payment. Add the details in the required fields on the online payment page and click ‘Make Payment’.

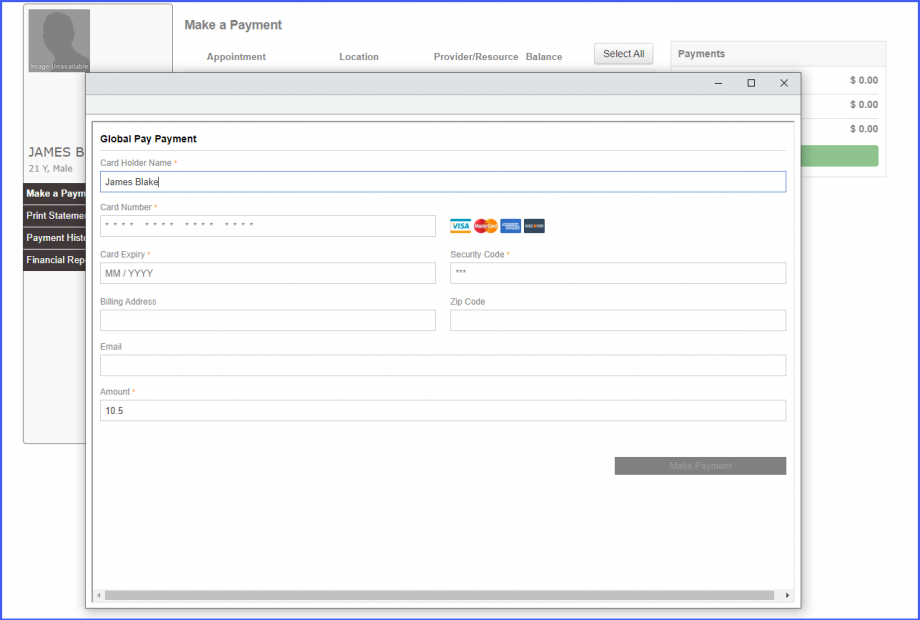

From Patient Portal:

For online payments through patient portal, follow the workflow Patient Portal > Select Patient > Select Charge > Online Payment. After landing on the ‘Global Pay Payment’ popup, type-in the required details and click on ‘Make Payment’.

Please create a support ticket to proceed further.